Outsourcing fintech development has become a strategic move for financial organizations seeking innovation, agility, and cost efficiency. As the fintech market continues to grow in 2025, more companies are leveraging specialized partners to accelerate product launches, ensure regulatory compliance, and stay ahead of digital transformation trends.

But how do you choose a reliable outsourcing partner? What are the risks and opportunities?

This guide will walk you through the latest market data, the pros and cons of fintech development outsourcing, key factors to consider when selecting a partner, and actionable steps for successful collaboration.

Whether you’re a startup or an established financial institution, use this guide to make informed decisions and unlock new growth with outsourced fintech solutions.

Market Trends and the Rise of Fintech Outsourcing

The fintech market is booming, and outsourcing is helping companies keep pace. This section highlights key trends and why fintech outsourcing is on the rise globally.

What is Fintech Development Outsourcing?

Fintech Development Outsourcing means delegating fintech software projects—like apps, payment systems, or compliance tools—to an external partner. These specialists bring deep domain knowledge, security expertise, and scalable resources to help you innovate faster and manage costs.

US & Global Fintech Market Growth

According to Fortune Business Insights, the global fintech market is projected to be worth USD 394.88 billion in 2025 and reach USD 1,126.64 billion by 2032, with a CAGR of 16.2% during the forecast period. (※1)

Another report from Custom Market Insights estimates the market is projected to grow at a CAGR of 16.5% from 2025 to 2034, reaching USD 255.1 billion in 2025 and an estimated USD 1,008.56 billion by 2034.

(※2)

The global fintech market is growing rapidly due to digital and mobile banking, adoption of cloud computing, and API-driven open banking. Advances in AI, cybersecurity, and analytics are driving demand for new financial solutions. With rising competition, outsourcing fintech development to trusted partners is becoming essential to stay ahead.

Why More Companies Outsource Fintech Development

Many financial organizations are turning to outsourcing due to talent shortages in AI, data, and cybersecurity and the high costs of in-house development. Outsourcing also enables faster launches, scalable solutions, and access to global fintech expertise that would be difficult to develop internally.

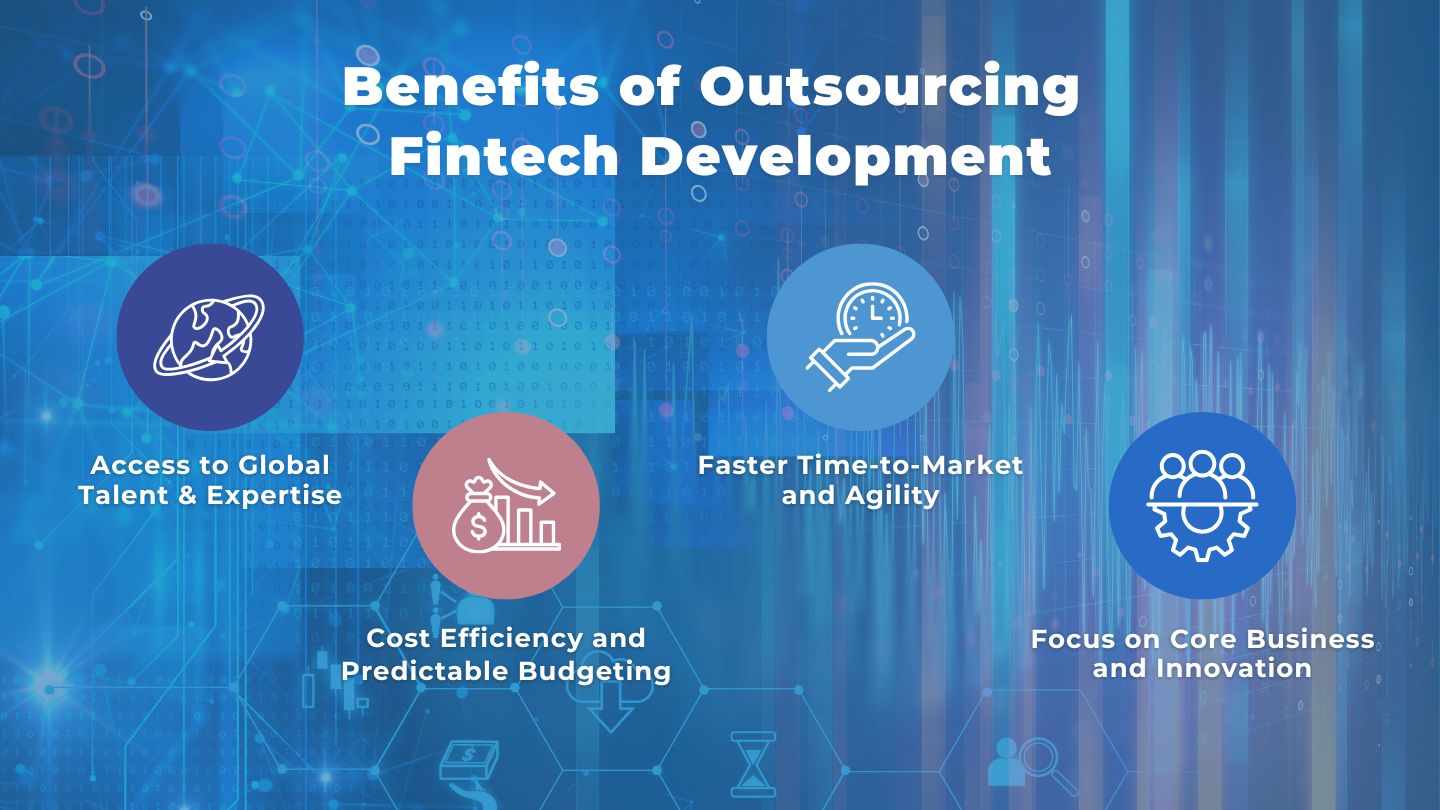

Benefits of Outsourcing Fintech Development

Outsourcing fintech development enables financial firms to innovate faster, manage costs, and maintain a competitive edge.

Cost Efficiency and Predictable Budgeting

Outsourcing reduces overhead associated with hiring, training, and infrastructure, while offering fixed or flexible pricing models that support budget control.

Access to Global Talent & Expertise

Companies gain access to experienced fintech engineers skilled in payments, APIs, and secure system architecture without long-term hiring commitments.

Faster Time-to-Market and Agility

Dedicated outsourcing teams accelerate project delivery and help businesses respond quickly to market changes and regulatory updates.

Focus on Core Business and Innovation

Internal teams can concentrate on strategic growth and innovation, while technical execution is handled by specialized partners.

Key Services You Can Outsource in Fintech

Fintech outsourcing covers a wide range of services that help financial organizations modernize systems, enhance security, and deliver seamless digital experiences.

Custom App & Software Development (Web/Mobile)

Outsourced teams can design and build web or mobile applications tailored to specific financial services, from online banking platforms to investment and lending apps.

Payment & Banking Solutions (Blockchain, AI, APIs)

Specialized providers develop secure payment gateways, digital banking systems, and AI-driven automation tools. In addition to blockchain-based transaction security and API integrations with traditional financial systems, cryptocurrency solutions are also part of the broader fintech landscape.

Regulatory Compliance & Data Security

Outsourcing partners ensure that products meet key financial regulations such as GDPR, PCI DSS, and AML, implementing strong encryption and data governance frameworks.

Integration, Cloud Migration & Maintenance

Service providers also handle system integration, cloud migration, and continuous maintenance, ensuring scalability, uptime, and efficient performance across all digital platforms.

Challenges and How to Overcome Them

While fintech outsourcing offers many advantages, it can present certain challenges, especially regarding security, quality, and communication. Here’s how to manage them effectively.

Data Security & Compliance (GDPR, AML, etc.)

Ensure partners meet global standards, conduct regular audits, and maintain transparent data practices. Strong data encryption, secure cloud environments, and continuous monitoring help prevent breaches and maintain customer trust.

Quality Control and Project Management

Set clear milestones, KPIs, and QA processes using Agile or DevOps frameworks. Regular progress reviews and automated testing ensure consistent product quality and faster issue resolution.

Communication and Cultural Differences

Select teams with strong English, overlapping work hours, and collaboration tools like Slack or Jira. Encouraging open communication and aligning on shared goals early reduces misunderstandings and builds long-term trust.

IP Protection & Vendor Reliability

Use NDAs, define IP ownership, and verify your vendor’s credentials before signing. Choosing partners with proven financial industry experience further safeguards proprietary technology and sensitive data.

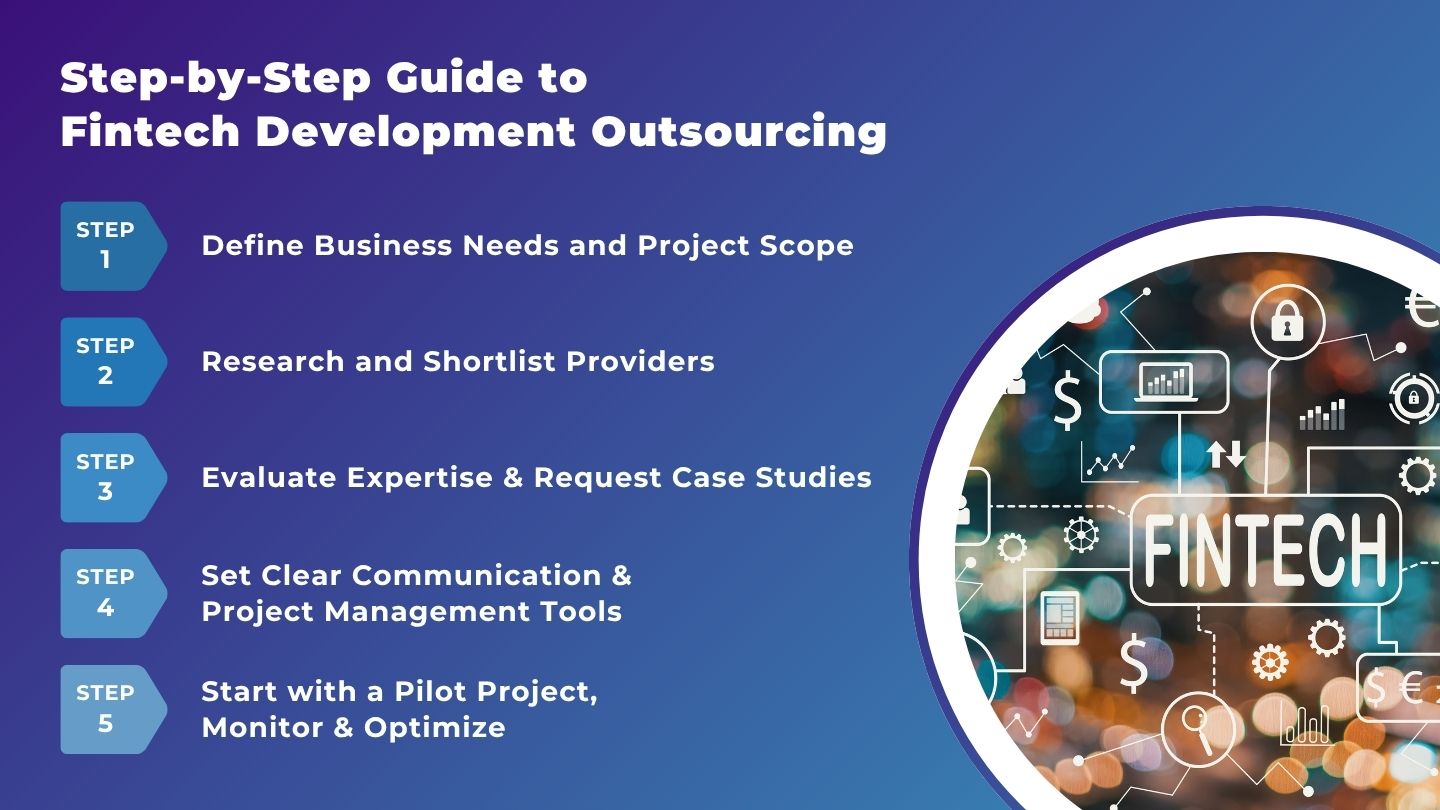

Step-by-Step Guide to Fintech Development Outsourcing

A structured approach to outsourcing helps financial firms select the right partner, reduce risks, and ensure successful project delivery.

Step 1: Define Business Needs and Project Scope

The first step is to clearly outline the business objectives, target users, and the project scope. This ensures alignment between internal teams and potential outsourcing partners from the start.

Step 2: Research and Shortlist Providers

Identify and compare potential providers based on their fintech experience, technical expertise, and client references. Shortlisting helps focus on the partners most likely to meet project requirements.

Step 3: Evaluate Expertise & Request Case Studies

Review each provider’s past projects and request detailed case studies. This helps assess their capabilities, problem-solving approach, and relevance to your specific fintech needs.

Step 4: Set Clear Communication & Project Management Tools

Agree on communication channels, reporting schedules, and project management tools such as Slack, Jira, or Trello. Establishing these early prevents misunderstandings and keeps the project on track.

Step 5: Start with a Pilot Project, Monitor & Optimize

Begin with a small pilot project to evaluate collaboration, delivery speed, and quality. Monitor progress closely and optimize processes before scaling up to full development.

For organizations seeking a long-term fintech partner, ISB Vietnam (IVC) provides expertise in legacy modernization, core banking portals, and scalable solutions.

Contact us today to learn more and explore collaboration opportunities.

Ready to scale your fintech vision?

Let’s collaborate to build secure, scalable, and future-ready fintech solutions.

Contact IVC for a Free ConsultationCase Studies: Successful Fintech Outsourcing Projects

ISB Vietnam (IVC) develops professional applications for the Japanese financial market, covering banking, stock trading, and foreign exchange systems. Our teams are skilled in developing detailed specifications and delivering high-quality fintech solutions through secure, scalable, and modern architectures.

Beyond Japan, ISB Vietnam (IVC) also supports fintech development for clients in Southeast Asia and other international markets, providing scalable and secure solutions tailored to regional compliance requirements.

Bank Account System Package Maintenance

Updating and maintaining design documents in Japanese based on the source code of local bank account systems.

Language: COBOL

Foreign Exchange System

Monitoring order status changes and real-time transaction updates in the forex market.

Languages: Java, JSP, JavaScript (AJAX), Oracle 10G

Other Development Examples:

- AI-Powered Legacy Code Modernization

- Core Banking Web Portal Development

- Periodic Batch Processing Systems for Banking Operations

Looking to accelerate your fintech innovation?

From legacy system transformation to next-generation banking platforms, we support financial enterprises aiming for innovation, compliance, and long-term growth.

Contact us today to explore collaboration opportunities.

Ready to scale your fintech vision?

Let’s collaborate to build secure, scalable, and future-ready fintech solutions.

Contact IVC for a Free ConsultationFrequently Asked Questions

Outsourcing fintech development often raises important questions about cost, security, and project management.

Below are key FAQs that help financial organizations make informed decisions when partnering with a fintech development vendor.

How much does it cost to outsource fintech development?

Fintech development outsourcing costs typically range from $30,000 to over $300,000, depending on project size and complexity. Basic apps with simple functions are cheaper, while advanced features like AI insights or fraud detection raise costs.(※3,4)

Conduct thorough research and obtain multiple quotes to ensure the best value. Partnering with vendors in cost-effective regions like Eastern Europe, Southeast Asia, or Latin America can further reduce expenses.

Which fintech services are best to outsource?

Services like payment solutions, compliance tooling, mobile/ web apps, and legacy modernization are commonly outsourced due to their need for specialised expertise.(※5)

How can you ensure data security?

Security is critical when outsourcing fintech development, as applications handle sensitive data like account and transaction details. Choosing partners with strong security practices, clear contractual obligations, open communication, and regular audits helps protect customer data and mitigate risk.

What are best practices for cross-border project management?

Effective cross-border fintech outsourcing requires clear governance, overlapping work hours, and robust collaboration tools. Setting milestones and KPIs while considering cultural and language differences ensures smooth project execution and successful outcomes.

Ready to take your fintech project to the next level?

Partner with ISB Vietnam (IVC) A trusted software development company with deep experience in banking, finance, and digital transformation.

Contact us today to discuss how we can help you build secure, scalable, and future-ready fintech solutions.

Conclusion

Fintech development outsourcing can serve as a strategic advantage, helping financial companies accelerate innovation, reduce costs, and access specialized expertise.

While ISB Vietnam (IVC) does not work with cryptocurrency, we have extensive experience in legacy system modernization and core banking solutions.

For organizations looking to strengthen their fintech capabilities and build a long-term relationship with a reliable technology partner, contact IVC today to explore how our expertise can support your next project.

Ready to scale your fintech vision?

Let’s collaborate to build secure, scalable, and future-ready fintech solutions.

Contact IVC for a Free Consultation

Reference

Data and insights in this article are based on the following sources:

- (※1)Fortune Business Insights: Fintech Market Report

- (※2)Custom Market Insights: Fintech Technologies Market Report

- (※3) Stepmedia Software: “How Much Does Fintech App Development Cost in 2025?”

- (※4) Techvify: “FinTech App Development Cost: Max ROI, Low Investment”

- (※5) BairesDev: “Common Outsourced Services in the Fintech Industry”